Be it people or companies, all of us insure every precious thing of ours. Insurance thus plays an essential part in our lives. Well, this is important to do as it is a good way of securing your future. Insurance companies sometimes have to pay huge amounts of money for claims.

Top 15 Biggest Insurance Claim Payouts Of All Time

1. China Earthquake, $1 Billion

The earthquake that hit China in May 2008 caused massive destruction in the country. Its magnitude was 8.0, and it killed over 65,000 people. It destroyed more than 80% of buildings in the area, and the estimated loss was $20 billion. But the claims were paid for only $1 billion.

2. SARS Outbreak, $1 Billion

This outbreak is one of the largest epidemics in history. The outbreak started in China, and it soon spread over 37 countries in the world, just like the present pandemic of coronavirus. Insurance claims for this pandemic stood for $1 billion.

3. Indian Ocean Earthquake, $1 Billion

This earthquake came in 2004 and took many lives, causing massive damage to life and property. It was one of the biggest natural disasters ever, and the insurance companies had to pay $1 billion for all the claims.

4. Eyjafjallajökull Volcano, $3.5 Billion

This volcano erupted in Iceland in the year 2010. Millions of passengers were grounded, and thousands of flights were canceled due to the burst of tiny dust particles in the air. The prices of the fuel also went down during this period because of the flight being canceled. The insurance claim for this was around $3.5 billion.

5. US/Canada Outage, $6 Billion

21 power plants were shut, and around 55 million people were without power in 2003. This was the most affected blackout in the history of the United States. Thousands of shops were closed, and people were even caught in the midst of amusement parks and other places. It is estimated that the insurance company had to pay a claim of $6 billion.

6. Hurricane Ike, $20.5 Billion

Cuba, Texas were hit hardest by hurricane Ike in December 2008, which caused heavy destruction. Buildings were demolished, many people lost their lives, and thousands of animals got killed. The insurance company paid $20.5 billion.

7. Northridge Earthquake, $20.6 Billion

This earthquake happened in January 1994 in America. It caused a great deal of loss to human life, and more than 40,000 buildings were destroyed. This earthquake made the insurance company pay a claim of $20.6 billion.

8. Hurricane Andrew, $25 Billion

This hurricane affected the areas of Bahamas, Florida, and Louisiana. It occurred in 1992 and was one of the deadliest of all. It killed around 65 people, and more than 60,000 homes were destroyed. The claim paid for this hurricane was $25 billion, and many insurance companies went bankrupt.

9. Tohoku Earthquake & Tsunami, $35 Billion

This tsunami came in 2011 and is called the great east Japan earthquake. This was also one of the most powerful earthquakes to hit this country, with a magnitude of 9.0. The insurance company had to pay $35 billion.

10. Hurricane Sandy, $36 Billion

By now, we have known that natural disasters take a huge toll on insurance companies. Similarly, hurricane Sandy in 2012 affected the areas of Canada and America, due to which companies had to pay $36 billion in insurance claims.

11. 9/11, $40 Billion

This incident was indeed one of the darkest days in America’s history and for the rest of the world too. More than 2000 people were killed, and the business interruption amount rose to be $11 billion. Victims of this attack also received claims. Insurance companies had to pay $40 billion, due to which the insurance companies later changed their policies and decided not to cover any cases of terrorism.

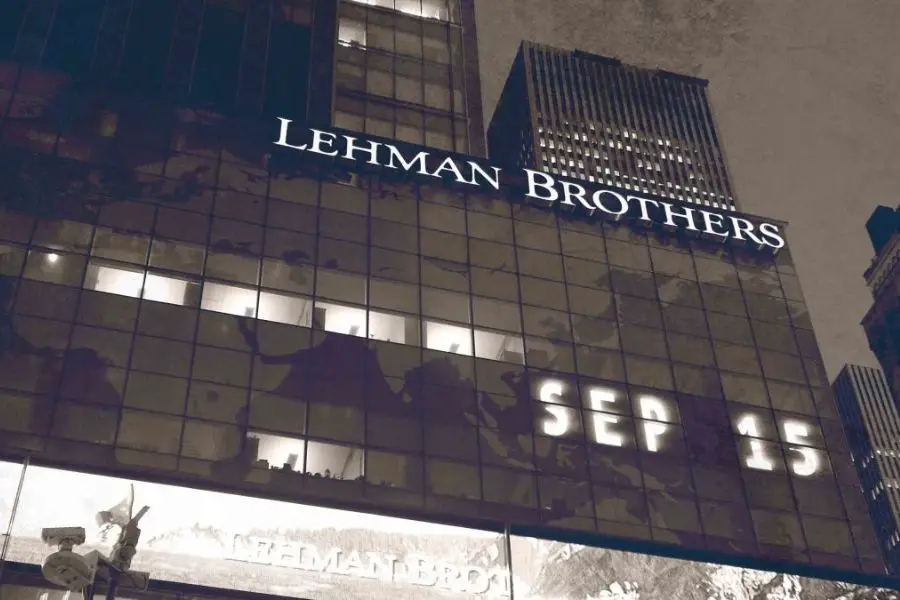

12. The Lehman Brothers, $100 Billion

In September 2008, the company Lehman Brothers filed for bankruptcy, making it one of the largest bankruptcy in the US’s history. The company was not able to clear its debts by selling its assets. Customers of this company were paid $100 billion.

13. Hurricane Katrina, Rita & Wilma, $130 Billion

Who hasn’t heard about these hurricanes, which killed more than 3000 people and injured innumerable masses? Thousands of people lost their homes, and the damages amounted to $158 billion, while the insurance companies paid an amount of $130 billion.

14. 2008 Financial Crisis, $21 Trillion

It was the worst financial crisis in history, and it was global. This really hit people individually, and the insurance companies had to pay a huge amount for this. However, it is considered that this coronavirus pandemic might overcome this one.

15. Rowan Atkinson Automobile Insurance, $12 Million

Rowan Atkinson, famously known for playing the character of Mr. Bean, had the most expensive car insurance in the world. He crashed his $84000 McLaren F1 and ended up getting a claim of more than $1200000 for the same.

Read also – Top 15 Most Followed Religions In The World